michigan gas tax revenue

Revenue from the motor fuel taxes is dedicated by the 1963 Michigan Constitution for transportation. Tax revenue in FY 2010-11.

Whitmer Takes Flak For Calling 20 Cent Gas Tax Hike Ridiculous

RAB 2022-121 This Revenue Administrative Bulletin RAB sets forth the sales tax prepayment rates.

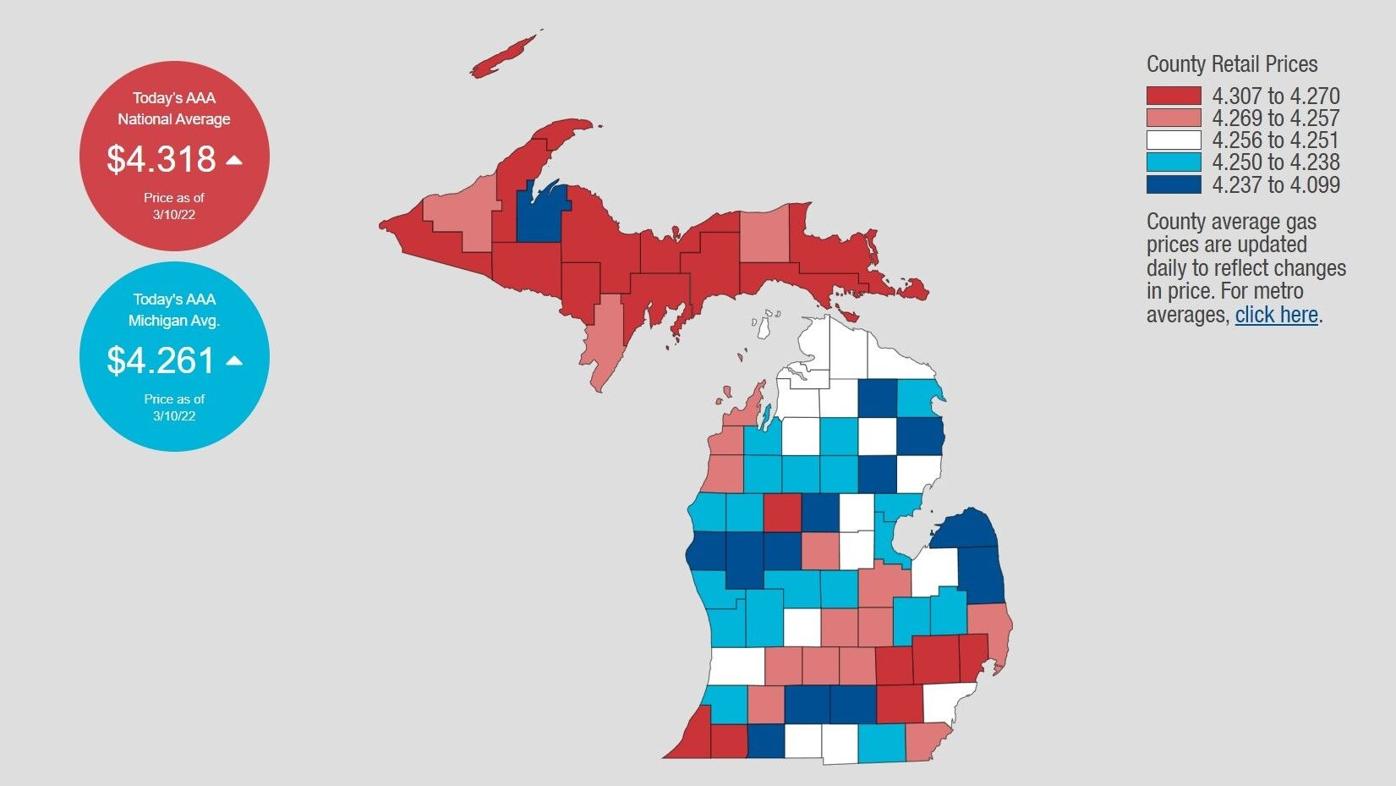

. According to AAA Michigans average gas tax price was 456 on Thursday. Producers or purchasers are required to report the oil and gas production and the. That is a responsible first step in ensuring that our.

Federal motor fuel taxes. Michigan Taxes tax income tax business tax sales tax tax form 1040 w9 treasury withholding. Motor Fuel - Letter of Inquiry Concerning Michigan Taxes.

30 0003 General Fund. Its important to future-proof Michigans. Notice Of Prepaid Sales Tax Rates On Fuel In Effect For The Month Of October 2022.

Federal Excise Tax In addition to Michigans 19-cent. A completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption. But that was based on an expected average price per gallon at.

The current federal motor fuel tax rates are. Combined business tax collections from the Single Business Tax Michigan Business Tax. We can shift out the sales tax at the pump and replace it with a revenue-neutral gas tax Chatfield told reporters Thursday.

Although directed to the Michigan Transportation Fund revenue from the Michigan gasoline tax broke 1000 million for the fifth time in the last 12 months. Sharing 240 0025 Comp. Federal Gas Tax 92 0184 Michigan Gas Tax 95 0190 Michigan Sales Tax 51 0102 School Aid 730 0075 Rev.

Federal excise tax rates on various motor fuel products are as follows. City Individual Income Tax Notice IIT Return Treatment of Unemployment Compensation City Business and Fiduciary Taxes. The Michigan Severance Tax Act MCL 205301 levies a tax on oil and gas severed from the soil in Michigan.

Motor fuel taxes are levied on. Michigan gas taxes averaged 456 a gallon on Thursday according to AAA and state senators say a tax savings plan would save about 50 cents a gallon. In Michigan the revenue from regular gasoline sales tax was projected to be 621 million in the 2022 fiscal year.

In all the nonpartisan Senate Fiscal Agency estimates the plan could cost the state up to 800. 0183 per gallon. It is estimated that fuel efficiency gains alone would lead to a 1 billion per year shortfall in Michigan gas tax revenue by 2050.

Income Tax CIT combined with less-than-expected IIT refunds to account for the over-forecast. In order to claim exemption the nonprofit organization must provide the seller with both. To ensure prompt and accurate delivery of Revenue Sharing payments to local units of government address changes must be reported to the Office of Revenue and Tax Analysis by.

Michigan Will Collect More Taxes Without Gas Tax Increase

Michigan Sales Tax Increase For Transportation Amendment Proposal 1 May 2015 Ballotpedia

Oregon Gas Tax Increase Asce S 2021 Infrastructure Report Card

Michigan Senators Seek Summer Pause On Gas Taxes Gov Gretchen Whitmer Encouraged Bridge Michigan

Covid 19 Pandemic Takes A Bite Out Of State Motor Fuel Taxes Citizens Research Council Of Michigan

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

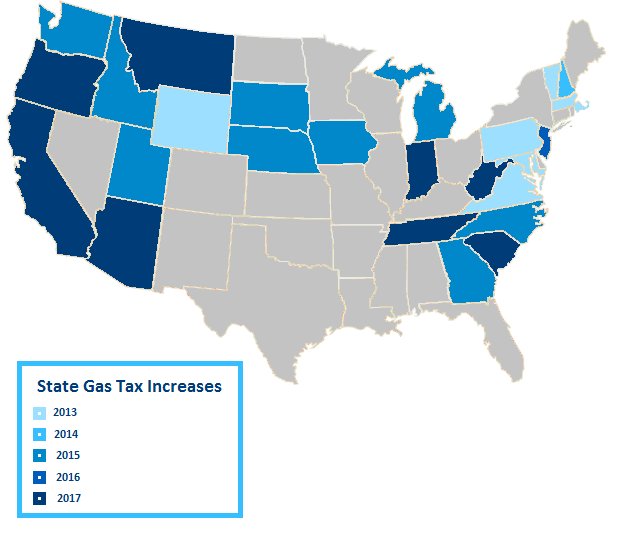

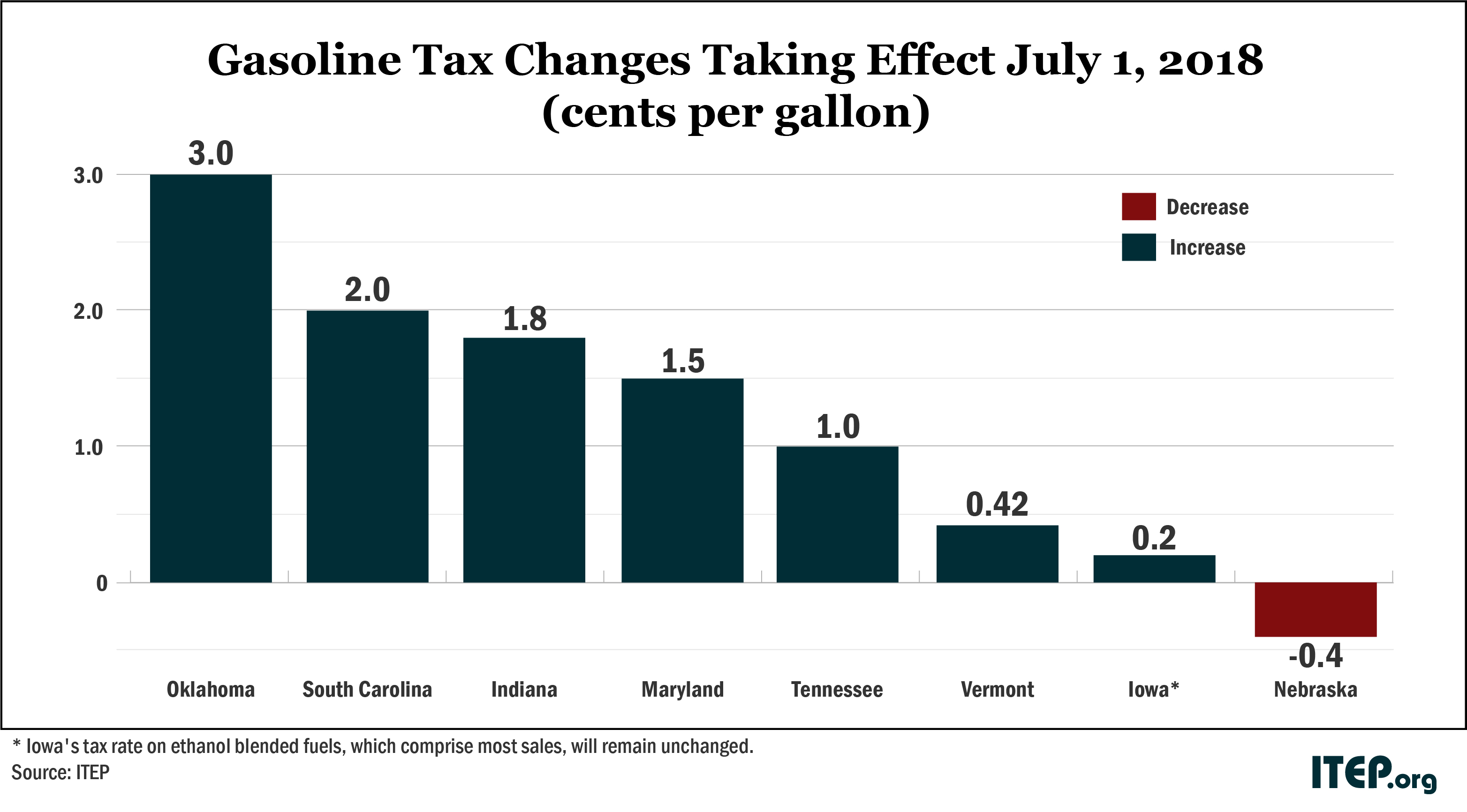

Gas Taxes Rise In Seven States Including An Historic Increase In Oklahoma Itep

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

Highest Gas Tax In The U S By State 2022 Statista

Michigan Can Spend Its Fuel Taxes On Roads Mackinac Center

Gas Tax Breakdown Where Michigan S Money Is Being Spent Now Wwmt

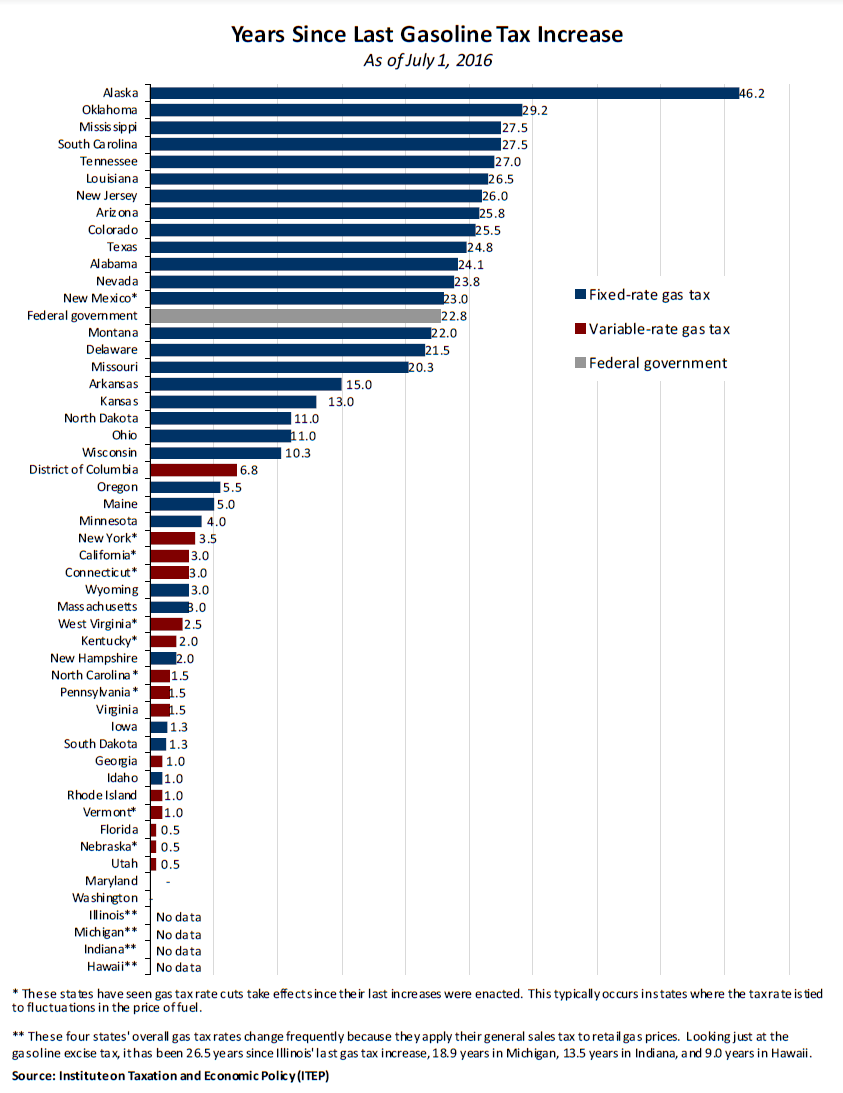

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Michigan Senate Gop Approves Gas Tax Nix That S Destined For A Veto

Michigan Breaks Records For Highest Gasoline And Diesel Fuel Prices State Abc12 Com

Michigan Governor Gretchen Whitmer Proposes Gas Tax Increase

Michigan Sales Tax Increase For Transportation Amendment Proposal 1 May 2015 Ballotpedia

Snyder Signs Road Bills That Hike Gas Tax Fees Crain S Detroit Business

House Approves 6 Month Pause Of Michigan S 27 Cent Per Gallon Gas Tax

Mlive Com Governor Whitmer And Most Democratic Lawmakers Said The Loss In Revenue Generated By Suspending The State S Gas Tax As Proposed By Republicans Would Be Problematic For Ongoing Construction Projects